Learn how to manage your finances as a Latino immigrant in the U.S. with PANA.

Emigrating to the United States is a challenge that will change your life in many ways and we understand the importance of this decision.

How do we know?

Many of us have been unclear about the importance of developing a stable financial management as an immigrant.

And we have been forced to understand that managing our financial resources will impact every aspect of our lives.

So, in this new country, you:

You want to become aware of your relationship with money.

You need to organize your finances to implement the habit of saving.

You want to visualize a goal that will allow you to optimize your financial stability in the USA.

Develop smart financial management

Our team of panas team has prepared a series of quick and practical exercises that will help you to develop a smart develop an intelligent management of your personal financesand above all, they will help you to focus your resources on fulfilling your dreams and goals to make them come true in this dreams and goals to make them come true in this country of opportunities.

In addition, you will achieve:

Define your budget.

To determine your expenses and debts.

Implement new saving habits.

Make smart purchases.

Define your budget.

Specify what your lines of credit are and what benefits you have with them.

Know a methodology that will help you optimize your finances.

Identify your financial goals as an immigrant in the United States.

Are you ready?

It will be 5 days to change your financial mindset and optimize your financial optimize your financial management in the United States.

The entire team of Pana will be with you, step by step, in these 5 days that will change your financial mindset.

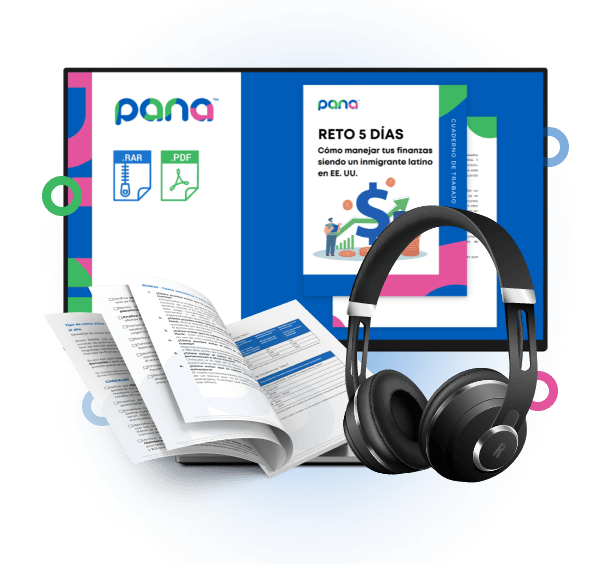

5-day challenge

- 1 introductory audio for each day of the challenge + actionable exercises that you can put into practice.

- 1 audio coaching.

- 1 workbook.

- 4 templates to download.

- 7 tips that you must take into account if you want to succeed as an immigrant in the United States.

If you share this challenge it will be even easier!

So invite a family member, friend or colleague to join this challenge that will transform your finances in the United States.

Pana is a financial technology company and is not a bank. All banking, banking-related services and FDIC insurance are provided by Piermont Bank, Member FDIC. The Pana Visa® Debit Card is issued by Piermont Bank pursuant to a license from Visa U.S.A. Inc. and can be used anywhere VISA debit cards are accepted. Your funds are FDIC insured up to $250,000 through Piermont Bank, Member FDIC. © 2022 Pana Finance Inc.